How to see the financial impact of key business decisions before they are made? By Mark Holton on Mar 9, 2020

How to see the financial impact of key business decisions before they are made? What a great firm mantra and key service offering to business clients. Around 25 years ago this is the statement that influenced me to go to a seminar in Sydney that started the business advisory service offering in my firm. I thought clients would love this let alone the fact that I needed it.

Over time I have come to realise that every client would love the opportunity of seeing the impact of key business decisions before they commit to them. They all think should I or shouldn’t I or will I or won’t I when a significant decision has to be made. Later I decided to brand this service Scenario Planning and extended it to see the impact of every debit and credit decision that clients make.

In order to get this service moving, we have to understand the impact of the small improvements. Every business has a code that underpins the way they operate from a financial viewpoint. Not knowing your client’s code is like walking through a maze blindfolded. The code of any business consists of the four drivers of profit and three drivers of the balance sheet.

The four drivers of profit are:

• Price

• Volume

• Direct costs/Cost of Goods

• Overheads

The three drivers of the balance sheet are:

• Accounts Receivable days

• Inventory days

• Accounts Payable days

These seven drivers are the principal levers of a business. They are the drivers that management should have some control over. Business improvement is driven by changes to these drivers.

As an Accountant/ Business Advisor your role should be to ensure that every one of your business clients understands how the seven drivers impact their profit their cash flow and value of their business. The most effective way to do this is through a simple concept called the Power of One. The Power of One shows the impact of a 1% improvement in the four drivers of profit and a one day improvement in the three balance sheet drivers.

Stated so simply that anyone can understand, the ‘bang for bucks’ of a 1% change really focuses attention on what needs to be done to improve the business. For example, take a look at the following table:

Note the huge impact that a 1% price increase has on profit, cash flow and value, compare that to the impact that selling 1% more has. Also, we can see the impact that an improvement of just one day has on cash flow and value.

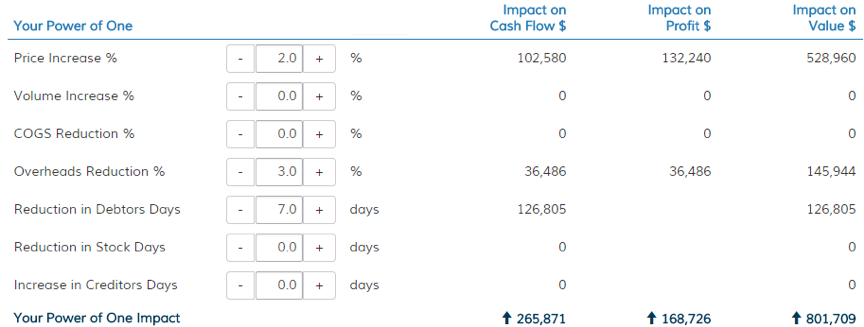

Now that you and your client understand the drivers, the next step would be to discuss the strategies that can be identified to improve the business. In the following example three relatively small changes have had a very significant impact on improving profit and cash flow and a massive improvement in the value of the business.

Once the goals have been agreed, they should be monitored regularly with new goals set each meeting. This then becomes the consistent interface for your client and you to run and monitor Board of Advice meetings quarterly or even monthly and drive them to greater profitability, stronger cash flow and to make their business worth more!

The Power of One is a dynamic way to demonstrate the financial impact of key business decisions before they are made. Knowing how far to adjust these levers and the impact of doing so is a crucial way to engage your clients and enhance your firm’s business advisory services.

Contributing Source:

The Power of One is a strategic feature of Cash Flow Story. www.cashflowstory.com.au.