The post How do accountants compete in a changing landscape? A digital adviser could be the answer. appeared first on Smithink.

]]>It’s all the harder, as most practices face the same staff issues. Labour markets are still tight, and good staff are hard to find and expensive to recruit and retain.

It leaves little time to devote to the idea of growing or future-proofing your practice.

The financial services landscape is also changing. At the end of last year, the government committed to supporting most of the QAR recommendations and digital advice. It reinforced the importance of using digital advice to achieve scale, affordability, and accessibility.

This has seen banks, Super Funds and Insurers jumping aboard the digital advice train.

It leaves accountants wondering how a small business can compete.

Is new tech a trusted friend or a threat?

We’re regularly told AI, robots, and technology are replacing roles across all industries. But we don’t often see how these things are being used to benefit the average working Aussie through new and affordable services that have previously been financially out of reach.

With out-of-the-box solutions that can be rapidly moulded to fit a variety of niches, professional services businesses are using it to open up opportunities and income streams simply and cost-effectively. One such example is financial advice.

For decades, offering financial advice to clients has been too costly and time-consuming for accountants. Not only did it require a license, but it was only suitable for a small section of their book, given the price tag of $2.5-$4.5k. But this is changing as regulation and compliant tech converge.

How digital advisers can service underserved clients

Now, accountants can implement a digital adviser, such as moneyGPS. Designed specifically for the 90% of Australians who cannot afford comprehensive financial advice, it enables accountants to provide value to clients they can never personally serve, opening up a new income stream for the price of a monthly subscription.

What is digital advice?

It’s accessible: single-topic personal advice ranges from $90-$270 per SOA.

It’s scalable: an unlimited ability to service clients every hour or day.

It’s cost-effective: subscription-based – and not a six-figure sum.

It’s compliant: delivered via the moneyGPS AFSL, meaning you don’t need your own license.

It’s totally dedicated: your digital adviser works 24/7 with no need for holidays.

It’s ahead of the curve: always up-to-date with regulatory changes.

It’s cohort neutral: happy to engage millennials, children of HNW, newbies entering the workforce or anyone with simple needs.

It’s referral-friendly: Keeps potential complex advice clients warm until they need face-to-face advice when they can be referred to your chosen partner.

Digital advice as a driver of growth

Now that digital advice is mainstream, and myths around it are being busted, enterprises, institutions and banks are jumping on board. Accountants have a once-in-a-decade opportunity to embrace this new technology to take their business to the next level of growth and profitability.

moneyGPS was a Finalist for Financial Planning Software of the Year in the Australian Wealth Management Awards for 2024.

The post How do accountants compete in a changing landscape? A digital adviser could be the answer. appeared first on Smithink.

]]>The post Running Effective Advisory Board Meetings: Tips and Best Practices appeared first on Smithink.

]]>An advisory board meeting is a collaborative and structured gathering where an organisation engages with a group of advisors and stakeholders to seek expert guidance and insights.

Running advisory board meetings for clients can be crucial for providing valuable guidance and support to your clients and enhancing the value of your business advisory services. Here are some tips for running effective board of advice meetings:

Prepare an Agenda

Create a clear agenda outlining the topics to be discussed during the meeting. Share the agenda with clients in advance so they can come prepared. In my experience, every board meeting I have attended is always preceded by an agenda and followed by an order of proceedings.

Foster Open Communication

Encourage open dialogue and active participation from all clients and your team. Create a supportive environment where everyone feels comfortable sharing their thoughts and concerns.

Focus on Client Needs

Keep the discussions client-centric and ensure that the advice provided addresses their specific needs and challenges. Conducting a needs analysis before these meetings is the best way to identify what is important to the client and help link solutions to these needs.

Provide Actionable Insights

Offer practical advice and actionable insights that clients can implement to improve their businesses or address their concerns. Concentrate on SMART Goals (Specific, Measurable, Achievable, Relevant, and Time-Bound).

Follow Up

After the meeting, follow up with clients to ensure they have the support and resources needed to act on the advice provided. Short, sharp telephone calls or online meetings keep the client focused on their goals and commit them to an accountability model driven by you.

Maintain Confidentiality

Respect the confidentiality of client information and discussions during the meeting to build trust and foster a sense of security.

Stay Informed

Keep yourself updated on industry trends, market changes, and regulatory updates to provide relevant and timely advice to your clients. Every meeting needs to look and feel slightly different to the client. Introduce new concepts gradually to build confidence with the client and make each meeting feel fresh and engaging.

Following these guidelines ensures that your advisory board meetings are productive and beneficial for your clients.

Benefits of Effective Advisory Board Meetings

Effective advisory board meetings can provide numerous benefits, including:

- Enhanced Decision-Making: Access to diverse expertise helps clients make informed decisions.

- Strategic Guidance: Clients receive strategic insights that align with their business goals.

- Networking Opportunities: Clients can connect with industry experts and peers.

- Accountability: Regular follow-ups and actionable insights ensure clients stay on track with their goals.

By optimising your advisory board meetings, you can offer significant value to your clients and strengthen your advisory services.

Mark is an expert in helping accounting firms optimise their strategic planning. If you would like to set up a complimentary 45-minute strategy assessment, please contact us.

The post Running Effective Advisory Board Meetings: Tips and Best Practices appeared first on Smithink.

]]>The post Unlock Your Accounting Superpowers appeared first on Smithink.

]]>The Power of 1%

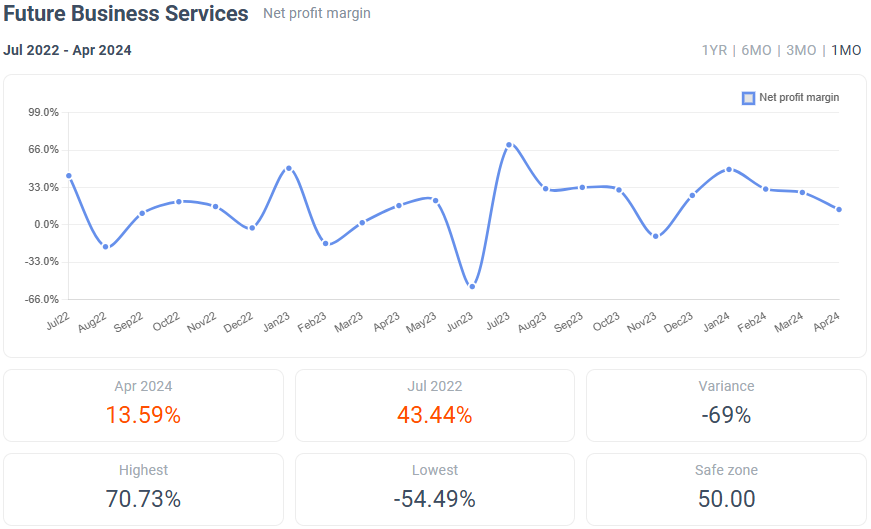

Scenario 1 – Your client’s crushing it

Your client’s gross and net margins are holding or increasing, but they have only 1.3 months of cash runway. Ideally, this should be between 3 and 6 months. Digging deeper, you find average debtor days at 39, cash conversion at 70 days, and creditors paid within 10 days. Despite profitability, cash is leaking.

Noticing this, you decide to dig a little deeper. The average debtor days are 39, cash conversion is 70 days, and creditors are paid within ten days. Despite profitability, the business is leaking cash. What can be done?

You create a 12-month forecast, reducing debtor days from 39 to 18 and extending creditor days to 30. This frees up $30k in cash for the business through a simple process change, adding real value.

Scenario 2 – Your client is struggling

First, assess debtor, creditor, and inventory to generate cash quickly. Analysing data, you find gross margins steady but net margins falling due to increasing wages. Overemployment is confirmed through revenue per employee analysis. Your insights and forecasts are crucial for your client’s business health.

Enhance Your Client Services

Every entrepreneur needs your analytical and advisory skills. Here’s what might be stopping you:

1: Lack of Skills/Structure

Smithink can provide a blueprint for your business.

2: Cumbersome Technology

Use platforms that are user-friendly and scalable, like Jazoodle.

3: Confidence

Start with key metrics and expand over time.

4: Service Levels and Pricing

Smithink can help define and price your services appropriately.

SMEs need your business advice services, and you can build a strong monthly recurring revenue stream.

If you would like to find out more about Jazoodle and how it can help your accounting firm find its superpowers, get in touch.

Andrew

Andrew Paton-Smith is the co-founder and CEO of Jazoodle. Jazoodle is an easy to use reporting, forecasting, and valuation platform for accountants and advisors. Jazoodle enhances your advisory superpowers and allows you to scale them across your client base. Find out more at www.jazoodle.com

The post Unlock Your Accounting Superpowers appeared first on Smithink.

]]>The post Building the Future of the Accounting Profession appeared first on Smithink.

]]>In this article, we will explore the importance of mentoring, the benefits it brings to both the team members and the firm, and best practices for implementing effective mentorship programs.

The Importance of Mentorship

Accounting is a complex and ever-evolving field that requires a deep understanding of regulations, standards, and best practices. Whether they are young accountants fresh from academic environments or professionals already working in the industry looking to advance their careers, many face significant challenges in their professional development. Mentorship is critical in bridging these gaps by providing guidance, support, and practical insights not always covered in textbooks or acquired through work experience alone.

Accelerating Skill Development

Mentors can help young accountants develop essential technical skills, such as financial analysis, auditing, tax planning, and compliance. Through hands-on training and real-world applications, mentees gain a deeper understanding of these concepts, enabling them to apply their knowledge more effectively and efficiently.

Enhancing Soft Skills

In addition to technical skills, mentors can also help develop crucial soft skills, such as communication, problem-solving, questioning skills, customer service and time management. These skills are vital for career advancement and professional success, as they enable young accountants to work effectively in teams, manage client relationships, and navigate complex projects.

Fostering Professional Growth

Mentorship provides a platform for young accountants to set career goals, receive constructive feedback, and build professional networks. Mentors can offer valuable advice on career progression, industry trends, and further education and certification opportunities. This guidance helps with decisions about career paths and develops a clear vision for the future.

Benefits for the Firm

Mentoring programs are not only beneficial for young accountants but also for accounting firms. Firms that invest in mentorship see numerous advantages, including:

Improved Employee Retention

Recruitment and retention of young team members is a constant challenge. By providing mentorship, firms can create a supportive and engaging work environment that encourages young accountants to stay and grow within the firm. This can lead to increased employee loyalty and reduced turnover.

Enhanced Firm Reputation

Firms known for their strong mentorship programs often attract top talent. Young professionals seek out firms that offer robust support systems and opportunities for growth. A reputation for excellent mentorship can give firms a competitive edge in the talent market.

Development of Future Leaders

Mentorship helps identify and nurture future leaders within the firm. By investing in the development of young accountants, firms can build a pipeline of skilled and motivated professionals who are prepared to take on leadership roles in the future.

Introducing FutureFocus Accounting Firm Mentoring

I am excited to introduce my innovative program, FutureFocus, to assist firms with the development of their young team members. With over 40 years of experience in the accounting industry, I have had the privilege of working with some of the best firms, partners, and managers.

FutureFocus is designed to share my insights, strategies, and knowledge to help young accountants excel in their chosen careers. This program will provide structured mentorship, personalised guidance, and valuable resources tailored to the unique needs of each young accountant, their firm and future industry leaders.

Mentoring young accountants is a vital investment in the future of the accounting profession. By providing guidance, support, and opportunities for growth, mentorship programs help young professionals develop the skills and confidence needed to succeed. For accounting firms, effective mentorship leads to improved retention, a stronger reputation, and the development of future leaders. With thoughtful planning and commitment, mentorship can be a transformative force, shaping the next generation of accounting professionals.

For more information on how FutureFocus can benefit you, feel free to reach out and discover how we can help build the future of the profession together.

I’m excited to share my insights, strategies, and knowledge to help young guns excel in their chosen careers.

Start a transformative journey with Mark’s one-year mentor program, tailored to guide your accounting career in the right direction. Unlock opportunities for growth and success with expert support.

The post Building the Future of the Accounting Profession appeared first on Smithink.

]]>The post Do we really need all this complexity? appeared first on Smithink.

]]>This complexity also brings some danger. Solutions can often be simpler than they appear, but dealing with the systems and processes can mean that the simple solutions are lost in a cloud of processes.

Perhaps I’m old school, but sometimes simplicity is much better, cheaper, and easier to manage, with more effective outcomes.

I wonder if people are losing faith in trusting their intuition. Have you read the book Blink: The Power of Thinking Without Thinking? It’s about mental processes that work rapidly and automatically from relatively little information. Spontaneous decisions being as good as carefully planned and considered ones.

How often have you interviewed someone for a role and known in the first minute whether you’ll employ them or not? I recall many occasions when it was obvious to me in the first 30 seconds that someone wasn’t the right fit, and I then had to spend the next 45 minutes talking to them so that they felt they had a fair hearing. Equally, I almost always knew straight away that someone was the right appointment. I never changed my initial impression. I was rarely wrong.

I wonder about the value of tests and surveys in helping identify the next emerging leaders. To me, it has always been obvious. Energy, enthusiasm, commitment, rapport, and talent can be obvious if you have regular cups of coffee with your team. I worry that surveys and tests will result in a blandness in leadership. There are many instances where left-field, out-of-the-norm appointments can bring a new vision and a new way of managing that can transform organisations. They may ruffle a few feathers, but they may also drive the organisation to new levels of success – think Jobs and even love him or hate him, Musk. I wonder if they would ever pass the leadership tests.

I get concerned about Net Promoter Scores, where management hides behind the apparent high scores of their business. I’ve seen instances of high scores where it is obvious to others in the organisation and customers that the business is failing to deliver. There are obvious examples related to the accounting profession. Over the years, I have conducted round table meetings with clients of many accounting firms. The qualitative feedback from these sessions has been invaluable in understanding what needs to be improved in customer service. As an aside, the top need communicated over and over again by clients was, “Please provide proactive advice that helps me manage my business better, sustain it for the future and/or build my family’s wealth”.

Do we really need surveys and complex assessments to help us identify what needs to be done to nurture a high-performing workforce? We’re overcomplicating it. What do the stars want? Over many years, my interviews with star team members have shown that they want interesting work, recognition, client contact, advancement, feedback, and opportunities to be challenged and developed. Few firms focus well enough on these basic things. Let’s get the basics right before we go further.

By now, I’ve probably offended half the business community, but I hope I might challenge you to take a step back and consider what you’re doing. Are we overcomplicating things? Can it be simplified? If it can be simplified, both your team and your clients will thank you.

Perhaps I’m getting old and grumpy. I think not. This blog has been growing slowly inside me for years. Like the boiling frog, one doesn’t notice the intrusion of complexity until it is too late. Now, say after me, “I’m as mad as hell, and I’m not going to take this anymore”.

David Smith conducts firm reviews and facilitates the development of strategic plans and business plans. Contact David at [email protected] to explore how he may be able to help your firm.

The post Do we really need all this complexity? appeared first on Smithink.

]]>The post Zero Tolerance for Process Compliance: A Blueprint for Success appeared first on Smithink.

]]>The first hurdle in achieving process compliance often lies in leadership. It’s not uncommon to find that leaders, in their quest to manage a myriad of responsibilities, may inadvertently bypass established procedures. This sends a conflicting message to the team, undermining the importance of processes and fostering a culture where shortcuts are tolerated. Addressing this challenge requires alignment among leaders, a shared commitment to adhering to processes, and leading by example.

Consistency is key. When different leaders enforce disparate processes, it creates confusion among the team, leading to inefficiencies and potential quality issues. Establishing a unified approach to processes sets a clear expectation for the entire firm and minimises the risk of deviation.

Once a cohesive framework is in place, it’s time to roll up the sleeves and review existing processes. Are they efficient? Are they necessary? Can technology be leveraged to automate tasks and enhance quality? It’s a continuous journey of improvement, striking the delicate balance between efficiency and quality that suits the firm’s unique needs.

Documentation is paramount. Clear guidelines, templates, and checklists ensure that everyone is on the same page, leaving little room for ambiguity. Regular training reinforces the importance of processes and keeps skills sharp.

But the work doesn’t stop there. Regular reviews are essential to ensure that processes are still effective and relevant. Innovation should be embraced, with someone appointed to spearhead process improvement initiatives.

Accountability cannot be overlooked. Zero tolerance means just that – if processes are not followed, there are consequences. Redoing work may seem counterintuitive in the face of tight deadlines, but it’s an investment in upholding process compliance and maintaining quality standards.

Peer reviews offer an additional layer of assurance. Randomly selected jobs undergo scrutiny by independent managers, ensuring not only process compliance but also technical accuracy and overall quality.

The impact of a focus on process compliance extends far beyond the confines of the firm. It enhances efficiency, boosts profitability, elevates work quality, enriches client service, and fosters team satisfaction. In an era of resource scarcity, it’s easy to lose sight of this critical aspect of operations. Yet, it’s precisely during such times that a steadfast commitment to processes can make all the difference.

So, don’t procrastinate. Appoint your process champion today and embark on the journey towards zero tolerance for process compliance. It’s not just a mantra – it’s a blueprint for success.

David Smith conducts firm reviews and facilitates the development of strategic plans and business plans. Contact David at [email protected] to explore how he may be able to help your firm.

The post Zero Tolerance for Process Compliance: A Blueprint for Success appeared first on Smithink.

]]>The post Mastering Client Engagement: A Guide to Asking the Right Questions for Business Success appeared first on Smithink.

]]>Initial Contact

Begin with understanding how prospective clients find you. This insight informs your marketing strategies and helps tailor your approach to attract the right clientele. Embed questions like “How did you discover us?” and “What services are you seeking?” in your contact forms to gauge their interests and needs. Don’t forget you can download our Needs Review Checklist here.

Building Relationships

Maintaining an open line of communication is key to nurturing client partnerships. Enquire about their onboarding experience and offer technical support when needed. By addressing concerns early on, you enhance client satisfaction and retention.

Expanding Services

As you deepen your understanding of clients’ businesses and financial goals, seize opportunities to offer additional services. Ask open-ended questions like “Where do you envision your business in five years?” to uncover new avenues for collaboration and growth.

Feedback Gathering

Implement surveys to gather feedback and insights from clients. Probe into their experiences and preferences to refine your offerings and enhance customer satisfaction. This data also informs targeted marketing strategies tailored to your client demographic. Read more on the importance of client feedback here.

Client Retention

When clients decide to move on, seize the opportunity to learn and improve. Ask probing questions like “What could we have done better?” and “Did we meet your expectations?” to understand areas for enhancement and increase client retention.

Ultimately, fostering open and honest communication builds stronger professional relationships. Clients value feeling heard and supported, fostering a sense of partnership with your firm. By asking the right questions and actively listening to your clients, you demonstrate your commitment to their success, ultimately fostering long-term business relationships.

Mark is passionate about empowering accountants through education and mentoring towards growth and excellence. Whether you’re seeking a dynamic presenter for your firm or event, or looking for personalised mentorship to nurture your rising talent, contact us to find discuss your needs.

The post Mastering Client Engagement: A Guide to Asking the Right Questions for Business Success appeared first on Smithink.

]]>The post The Love Of Learning appeared first on Smithink.

]]>As Leonardo Da Vinci said, “Study without desire spoils the memory, and it retains nothing that it takes in”. Igniting the spark of the love of learning manifests itself in many unexpected forms. Between picking up a new language before setting sail on a European honeymoon, figuring out how to fix a flat tyre you’ve busted on the freeway to learning how to parent your first child – the love of learning is an integral part of the human experience.

To foster this love of learning encourages growth and is an important part of managing both your personal growth and also that of your business. When open to discovering new things, your skill set can only expand and your motivation to build on existing knowledge grows with it.

Psychologist, Jin Li discovered that the Chinese have a concept that roughly is paraphrased into, the want and need to learn is what the heart and mind want. Western culture may experience shame or guilt when met with the inability to learn and therefore achieve whereas this Chinese model suggests that the shame comes from not wanting to learn.

This is an interesting concept to deep dive into when it comes to businesses in the Western world. The emphasis on the notion of ‘failure’ especially when in the context of business could be linked back to a lack of knowledge, an unwillingness to learn new skills, or a lack of curiosity when it comes to pivoting to encapsulate a new business landscape.

The love of learning also means a love of flexibility. An essential skill to possess when managing your business and staff. The ability to pivot and reassess at a moment’s notice can be taught through experience but also studied and honed for when challenges arise. The whole notion of learning means having an inherent love of flexibility as your mind grows around new subject matter and skills.

To love the act of learning, it is crucial to maintain motivation. Usually, an end goal or incentive is a wonderful way to expand your knowledge and that of your staff. Providing training courses for your staff gives them a sense of accomplishment while also expanding upon their skillset, therefore making your business stronger and setting your employees apart from the rest.

Not all teachable moments have to be about achieving direct business goals either. Motivational events that encourage morale are a great way for you and your staff to retain their passion for learning new things. Cooking classes, escape rooms, and trivia nights are just some examples of building a long-lasting professional relationship with those who work with you while making sure the learning you’ve invested in is fun. By sharing the love of learning with others you’re sure to create a bond that benefits all.

There are activities you can utilise to learn alongside your staff. Often when checking in with your employees, you can enquire about their love to learn. Questions such as, ‘If you could share something you’ve learned this week, what would it be?’, or ‘What would you teach us if you could teach us any new skill?’. The questions would differ between older and younger staff. Older staff might be asked, “What would you like to learn about technology that challenges you?”. Whereas you could ask younger staff, “What is something you would like to learn?”. By creating the space for your staff to reveal their love of learning, you can make the best decisions on how to foster their progression within your business.

The accounting industry is ever-evolving, and continuous learning is not just a choice but a necessity for staying relevant and competitive in the field, so why not embrace it?!

Channel your inner Philomath (from the Greek ‘Philos’ meaning lover of learning and study), and delve into what makes you want to reach out for more knowledge. What challenges you to become a better business and manager and how can the love of learning benefit you and improve your life both personally and in business? Whether it be improving your skill set, expanding your business comprehension, rewarding your staff’s curiosity, learning how to make pasta or winning your work trivia night – learning is always something to celebrate. Opa!

Mark is passionate about empowering accountants through education and mentoring towards growth and excellence. Whether you’re seeking a dynamic presenter for your firm or event, or looking for personalised mentorship to nurture your rising talent, contact us to find discuss your needs.

The post The Love Of Learning appeared first on Smithink.

]]>The post The Accountants’ Guide to Fishing appeared first on Smithink.

]]>Do you have attractive bait?

As any good fisherman knows bait is critical. I’ve never “got” plastic bait, particularly in estuary fishing – the fish are not that stupid! Anyway, it is interesting how fickle fish seem to be. Some love pilchards, some prawns, some squid or worms. How do you know what to use?

It is the same with clients and prospects. Different clients can be attracted to different service offerings. These preferences will change over time as the client’s circumstances change. Unless you want to attract a very narrow range of clients you need to experiment with a broad range of service offerings to see what will work. Some clients may be attracted to simple down to earth services to help them manage their cash flow more effectively. Others may be looking for more holistic services that address their business and personal financial strategies. It is critical that you experiment to determine what offerings are attractive to clients.

Have you developed the right fishing skills?

Far more important than tackle is having the right skills. You can have all the best gear in the world but if you don’t know how to use it it all can be a waste. Often one can find some of the best fishermen using very basic lines, hooks and bait but they know how to use it to great effect.

It’s an unfortunate fact that many practitioners have made the mistake of investing in business advisory software, without ensuring that they and their team have developed the right skills and processes to ensure that a quality service can be delivered that clients will want to buy on a regular basis. All too often early enthusiasm in building advisory services is lost when practitioners realise that there is much more involved than merely purchasing the latest software tool.

It was for this reason that we developed our Business Advisory EnablerTM process – a 7-step process that practitioners should follow to ensure the successful development of their business advisory services. Client engagement is key, software tools are important but not critical. Key elements are developing strong relationships with clients and having conversations that unlock the issues the client is trying to address.

Do you have the right tackle?

Of course, having the right tackle is important when fishing. Having hooks too big for the fish you’re trying to catch; not using sinkers when the fish you want are on the bottom; having a line that is too light or heavy all need to be considered. The key consideration is “What type of fish am I trying to catch”?

It’s the same with business development. What type of client am I trying to catch? Have I developed my service offerings around their needs? Are there specific industries where I can add additional value from my specific knowledge of how those industries operate?

Sales 101 is “know thy customer”. When was the last time you strategically thought about your clients, the issues they’re facing and the services that you could provide to help clients address those challenges?

Only when you’ve determined what you’re trying to achieve should you go down to the tackle shop (the software vendors) and find tools that will equip you to provide the services that you have determined are best for your clients and your practice.

Are you fishing in the right place and at the right time?

You can have all the right gear but if you don’t find the right spot and fish at the right time it can all be a fruitless exercise, except of course for the joy of quiet contemplation.

Knowing which clients to target is a critical piece of the puzzle. Not all will be interested in additional services. Consider as well when you should approach clients. What are peak times in their business when they will be too busy to consider additional ways you may be able to assist them? What life events may be occurring for your client that will trigger the need for particular additional services? Tracking these life events are positioning services that will assist clients in meeting these new challenges can be a highly business development strategy.

Are you using berley to attract the fish?

Getting more fish hovering around the boat will obviously increase one’s chances of a catch. It’s the same in your firm. Having more people aware of your services or using low cost add on services to compliance is a good way to build trust and show that you can do more than be a tax and accounting compliance accountant. How are you getting more people hovering about your boat? Newsletters, seminars, speaking engagements, social media and more are all critical pieces of practice berley.

SMSF can often be a good place to start in offering a low cost add-on service by offering a free review of the fund – this will lead to discussions around retirement planning, succession, estate planning etc. But by starting with offering a simple low cost service you can open the door to bigger opportunities.

So as you’re getting some time off before 2024 starts its frenetic place, consider what might be your fishing plan for 2024.

David Smith conducts firm reviews and facilitates the development of strategic plans and business plans. Contact David at [email protected] to explore how he may be able to help your firm.

The post The Accountants’ Guide to Fishing appeared first on Smithink.

]]>The post Hard decisions appeared first on Smithink.

]]>There’s that staff member who is just not performing because perhaps they’re too lazy or just don’t get it. Your excuse is that it’s hard to find staff and the employment laws are so onerous that maybe keeping the person is better than going through the angst of removing them. But is that true? Are you sure? Could the main reason be that you just don’t want the tough discussion, you don’t want to tell them that they have to go? It’s ten times worse if that person is a partner!

There’s that client who is a right pain in the… The client who is so demanding, never pays their fees on time, complains about the bill, and is hopeless at providing accurate and complete information on a timely basis. The client who should be told to shape up or ship out. Every firm has them and yet few do anything about it.

As an external adviser, these hard decisions seem quite obvious. Part of my role is to make you uncomfortable so that you will no longer accept this situation so that you will act. Prodding you in the right place!

The great observation is that I rarely see anyone who regrets the hard decision. Making it, acting on it, and doing what you might have to do might be painful for all involved but it’s like a surgeon removing a cancer, the host may be temporarily weakened but will grow and thrive by being unburdened by the issue that has been nagging you – sometimes for years.

So perhaps it’s time for a New Year’s resolution or two. Undertake a search for these bad smells/elephants in the room – they won’t be hard to find – you know where they are. Decide that by the end of January you will act. What a way to start the new year – unburdened and energised.

David Smith conducts firm reviews and facilitates the development of strategic plans and business plans. Contact David at [email protected] to explore how he may be able to help your firm.

The post Hard decisions appeared first on Smithink.

]]>